Definition

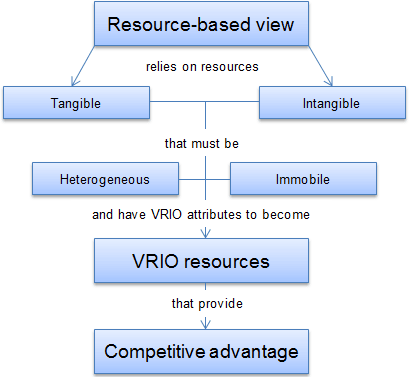

The resource-based view (RBV) is a model that sees resources as key to superior firm performance. If a resource exhibits VRIO attributes, the resource enables the firm to gain and sustain a competitive advantage.[1]

What is a resource-based view?

RBV is an approach to achieving competitive advantage that emerged in the 1980s and 1990s after the major works published by Wernerfelt, B. (“The Resource-Based View of the Firm”), Prahalad and Hamel (“The Core Competence of The Corporation”), Barney, J. (“Firm resources and sustained competitive advantage”) and others.

The supporters of this view argue that organizations should look inside the company to find the sources of competitive advantage instead of looking at the competitive environment for it.

The following model explains RBV and emphasizes its key points.

According to RBV proponents, it is much more feasible to exploit external opportunities using existing resources in a new way rather than trying to acquire new skills for each different opportunity. In the RBV model, resources are given the major role in helping companies to achieve higher organizational performance. There are two types of resources: tangible and intangible.

Tangible assets are physical things. Land, buildings, machinery, equipment and capital – all these assets are tangible. Physical resources can easily be bought in the market, so they confer little advantage to the companies in the long run because rivals can soon acquire identical assets.

Intangible assets are everything else that has no physical presence but can still be owned by the company. Brand reputation, trademarks and intellectual property are all intangible assets. Unlike physical resources, brand reputation is built over a long time and is something that other companies cannot buy from the market. Intangible resources usually stay within a company and are the main source of sustainable competitive advantage.

The two critical assumptions of RBV are that resources must also be heterogeneous and immobile.

Heterogeneous. The first assumption is that skills, capabilities and other resources that organizations possess differ from one company to another. If organizations had the same amount and mix of resources, they could not employ different strategies to outcompete each other.

What one company would do, the other could simply follow and no competitive advantage could be achieved. This is the scenario of perfect competition, yet real-world markets are far from perfectly competitive and some companies, which are exposed to the same external and competitive forces (same external conditions), are able to implement different strategies and outperform each other. Therefore, RBV assumes that companies achieve competitive advantage by using their different bundles of resources.

The competition between Apple Inc. and Samsung Electronics is a good example of how two companies that operate in the same industry and, thus, are exposed to the same external forces can achieve different organizational performance due to the difference in resources.

Apple competes with Samsung in tablets and smartphone markets, where Apple sells its products at much higher prices and, as a result, reaps higher profit margins. Why does Samsung not follow the same strategy? Simply because Samsung does not have the same brand reputation or is capable of designing user-friendly products like Apple does. (heterogeneous resources)

Immobile. The second assumption of RBV is that resources are not mobile and do not move from company to company, at least in the short-run. Due to this immobility, companies cannot replicate rivals’ resources and implement the same strategies. Intangible resources, such as brand equity, processes, knowledge or intellectual property, are usually immobile.

VRIO framework

(Please visit our article on VRIO framework for more information.)

Although having heterogeneous and immobile resources is critical in achieving competitive advantage, it is not enough alone if the firm wants to sustain it. Barney (1991) has identified a VRIN framework that examines if resources are valuable, rare, costly to imitate and non-substitutable.

The resources and capabilities that answer yes to all the questions are the sustained competitive advantages. The framework was later improved from VRIN to VRIO by adding the following question: “Is a company organized to exploit these resources?”

VRIO framework adopted from Rothaermel’s (2013) ‘Strategic Management’, p.91

Question of Value. Resources are valuable if they help organizations to increase the value offered to the customers. This is done by increasing differentiation or/and decreasing the costs of production. The resources that cannot meet this condition lead to competitive disadvantage.

Question of Rarity. Resources that can only be acquired by one or a few companies are considered rare. When more than a few companies have the same resource or capability, it results in competitive parity.

Question of Imitability. A company that has valuable and rare resources can achieve at least temporary competitive advantage. However, the resource must also be costly to imitate or to substitute for a rival if a company wants to achieve sustained competitive advantage.

Question of Organization. The resources itself do not confer any advantage for a company if it’s not organized to capture the value from them. Only the firm that is capable to exploit the valuable, rare and imitable resources can achieve sustained competitive advantage.

Difference between resource-based and industrial organization views

RBV holds that sustained competitive advantage can be achieved more easily by exploiting internal rather than external factors as compared to industrial organization (I/O) view. While this is correct to some degree, there isn’t a definite answer to which approach to strategic management is more important.

The chart [1] below shows how industry, firm and other effects explain a firm’s performance. From ~30% to ~45% of superior organizational performance can be explained by firm effects (resource based view) and ~20% by industry effects (I/O view). This indicates that the best approach is to look into both external and internal factors and combine both views to achieve and sustain competitive advantage.

Sources

- Rothaermel, F. T. (2012). Strat.Mgmt.: Concepts and Cases. McGraw-Hill/Irwin, p. 5

- Barney, J. B. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, Vol. 17, pp.99–120.